Solvency Index

Creditreform's credit rating shows the company's current solvency and is easy to use when making decisions concerning credit limit or terms of payment.

- The key component of our commercial credit reports

- The complex principle of solvency estimation

- Illustrative and handy tool for quick solvency and creditworthiness assessment

- Calculated on the basis of a large number of qualitative and quantitative factors

Structural risks

- Legal status

- Line of business

- Years in business

- paid-up capitals

- Number of employees

- Turnouver / staff

Financial & liquidity

- Financial structure

- Asset turnover

- Liquidity analysis

- Balance sheet data

- Payment manner

Credit assessment

- Court records

- Negative features

- Debt collection

- Credit requirements

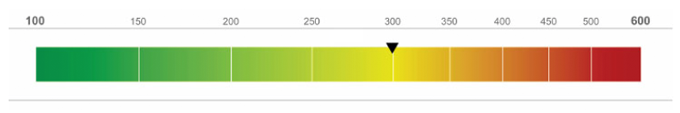

| Solvency Index | Possibility of Default | Risk Indication |

|---|---|---|

100 - 193 |

0.00% - 0.30% | Low Risk |

194 - 229 |

0.31% - 0.70% | Lower than Average Risk |

230 - 294 |

0.71% - 3.00% | Average Risk |

295 - 353 |

3.01% - 8.00% | Moderate Risk |

354 - 439 |

8.01% - 30.00% | Medium Risk |

440 - 600 |

30.01% - 95.53% | High Risk |

A credit rating is calculated on the basis of information as collected from reliable sources. A credit report and a credit rating provide supplementary information to our clients in their decision-making. (3ACredit or Creditreform or any of their officers or employees assumes no responsibility for the results of these decisions.)